Sponsored

Your First Private Lender Deal

What Borrowers and Lenders Should Know Before They Shake Hands

Private lending is one of the most powerful tools in real estate—and one of the easiest to misunderstand. Whether you’re borrowing or lending, your first deal sets the tone for every one that follows. Let’s look at it from both sides of the table.

If You’re the Borrower

Your first goal is trust. Private lenders invest in you as much as the property. Be transparent about your numbers, your plan, and your timeline. Have a deal summary with purchase price, rehab, ARV, and exit plan. Show your math—how much you need, how long you’ll need it, and how the lender gets repaid. Protect their capital with recorded documents and proper insurance. Never ask a lender to “trust you” without paperwork. Deliver on your first deal and you’ll never struggle to find funding again.

If You’re the Lender

Your job isn’t just to say yes—it’s to protect your principal. Don’t fund enthusiasm; fund competence. Verify the deal, get the address, see photos, and review a basic scope of work. Document everything—a note, deed of trust or mortgage, and insurance naming you as loss payee. Start small. Even $25K or $50K helps you learn the process with manageable risk. When structured correctly, private lending can outperform most investments—with collateral you can touch.

The Bottom Line

For the borrower, it’s about credibility. For the lender, it’s about security. When both sides respect those priorities, private lending becomes one of the safest and most profitable partnerships in real estate.

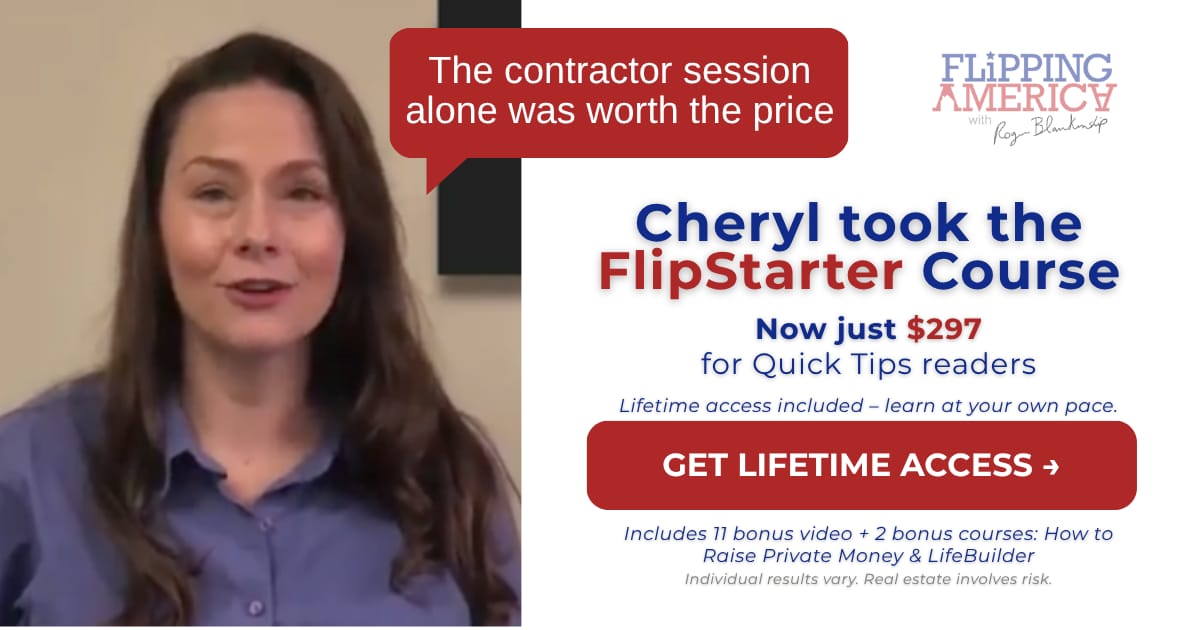

Sponsored

I’ve met plenty of people chasing money — and a few chasing meaning. The best ones find both. Real estate gave me the freedom to help others, and that’s what drives everything I teach in FlipStarter.