Master ChatGPT for Work Success

ChatGPT is revolutionizing how we work, but most people barely scratch the surface. Subscribe to Mindstream for free and unlock 5 essential resources including templates, workflows, and expert strategies for 2025. Whether you're writing emails, analyzing data, or streamlining tasks, this bundle shows you exactly how to save hours every week.

The Smartest Deal You’ll Ever Make Might Be the One You Don’t

Every investor loves the thrill of the hunt — the chase for that next great deal. But one of the wisest moves an investor can make isn’t signing the contract… it’s knowing when not to.

⚠️ A Rule I Live By

Walk away when profit demands perfection.

If everything has to go right for you to make money — the contractor has to finish early or on time, the rehab has to stay on budget, the buyer has to appear at full price, and the interest rate can’t tick up — then your “deal” isn’t a deal at all. It’s a tightrope.

Something always goes wrong. Materials get delayed, hidden damage pops up, the appraisal comes in light, or the market slows just when you’re ready to sell. If one unexpected event can wipe out your profit, you’re betting on luck, not skill.

🧭 Know Your Walk-Away Triggers

The numbers only work in the best-case scenario.

Repairs, permits, or timelines rely on “hope.”

You find yourself adjusting the spreadsheet just to make it work.

You feel emotional pressure — not logic — pushing you forward.

If any of those sound familiar, it’s time to pause. No property is worth losing your peace of mind or your capital.

💡 The Smart Investor’s Perspective

Walking away isn’t failure — it’s wisdom. Every “no” protects your ability to say “yes” when the right deal comes along.

As my good friend, the great Gordon Catts says, “Good deals are like streetcars. Another one will be along in a few minutes.” There’s always another property. There’s only one you.

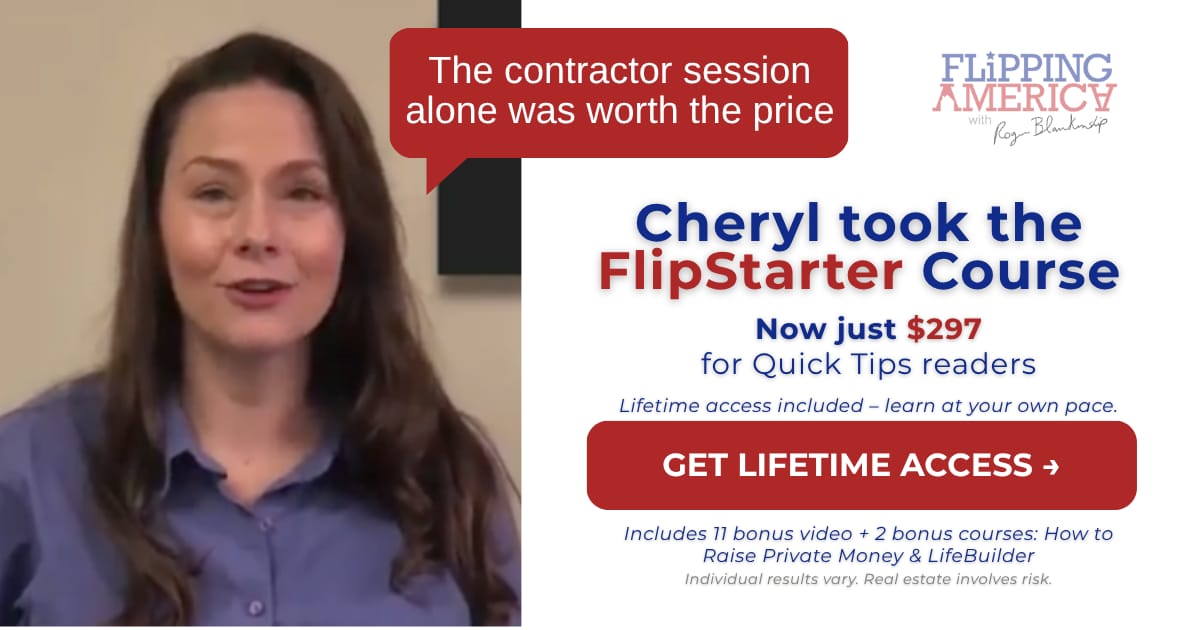

Sponsored