But First, A Shameless Plug

To Real Estate Agents: You’re Closer Than You Think

You already know how to find deals, read comps, and write contracts.

Yet you’re still trading hours for commissions—while your investor clients build wealth.

Why most agents don’t invest:

“I don’t have $50K for a down payment.”

“I can’t qualify for another loan.”

“I need my cash liquid.”

I’ve been there.

I’ve done over 2,000 deals—and more than 1,000 of them used none of my own money.

Not gimmicks. Not gray-area nonsense. Real acquisition structures that actually work.

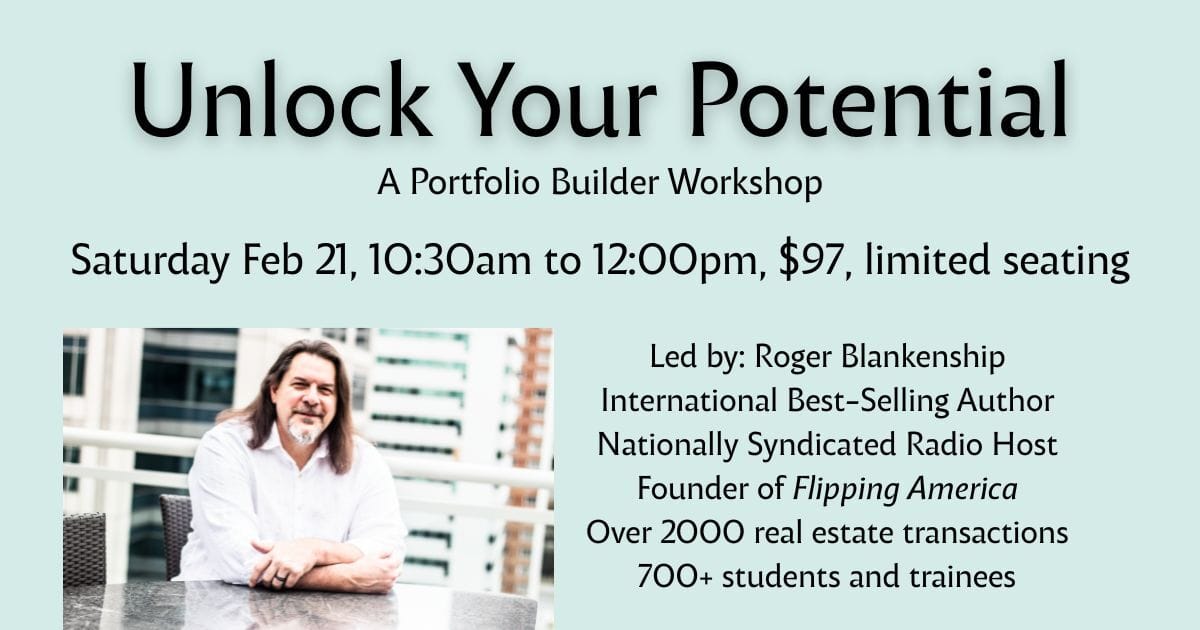

This Saturday, Feb 21 at 10:30am, I’ll show you exactly how:

Subject-to deals

Seller financing

Master lease options

Joint Venture Partnerships

Structuring offers sellers say yes to

Real numbers from real deals

$97. One session.

👉 Register here.

You already have the skills.

Add deal structuring—and start using them for yourself.

Title Insurance Redundancy: Stop Paying Twice

Here’s a question nobody at the closing table wants you to ask:

“Why am I paying for a title search when this property sold 18 months ago?”

The closing attorney will look uncomfortable.

The title company rep will suddenly need to “review the file.”

Your real estate agent will kick you under the table.

Because the honest answer is:

“You probably shouldn’t be.”

The Title Insurance Scam Nobody Calls a Scam

Title insurance protects you from ownership disputes, liens, and claims against your property. It’s essential.

What’s not essential is paying to rediscover the same facts someone else already paid to discover—recently.

Title insurance is one of the few things you buy where the seller did all the research 2–3 years ago…and you’re charged to do it again, cover to cover, as if none of it ever happened.

Imagine hiring a home inspector, getting a 40-page report, then selling the house 18 months later.

The new buyer hires another inspector, who produces the same 40-page report, because nothing has changed.

We’d call that wasteful.

At a minimum, we’d ask a follow-up question.

Yet at closing, nobody blinks—because closing costs are a fog of line items, and everyone just wants the keys and a working pen.

The Alternative Nobody Mentions

In 41 states, you can request a title update (also called a bring-down or reissue rate) instead of a full title search.

What you’re really saying to the title company is:

“Don’t rerun every test. Just tell me what’s changed since the last exam.”

A full title search typically costs $800–$1,200.

A title update usually runs $150–$300.

Coverage: identical.

The title company confirms the prior policy is valid, searches the public record from the last sale date forward, verifies no new liens or claims appeared, and issues your policy.

Same protection.

Less redundant work.

A much smaller bill.

When This Works

This typically works if the property sold within the last three years.

The prior title policy must be from a reputable underwriter—Fidelity, First American, Stewart, Old Republic, Chicago Title. If the seller closed with Bob’s Title Shack and Bait Shop, you’re getting a full search.

This applies to primary residences, investment properties, and even commercial buildings. The exact window varies by state, but some version of this is available in most of the country.

When This Doesn’t Work

If the property was inherited, gifted, or transferred outside a normal arms-length sale, you want the full search.

Same goes for foreclosures, bankruptcies, divorces, quitclaim deeds, and tax sales. Those situations create exactly the kind of title issues full searches are meant to catch—and that’s money well spent.

How to Actually Do This

Once you’re under contract, say this—calmly and clearly:

“The property last sold on [date]. I’d like to request a title update from the prior policy instead of a full search.”

You’ll get one of two responses:

“Sure—let me pull the prior policy.”

A look usually reserved for unlicensed medical procedures.

If it’s the second, find a different title company. This isn’t exotic. It’s standard practice—it just happens to benefit you instead of their invoice.

Ask for the prior policy number and underwriter. If the seller doesn’t have it, it’s in the county records. Any competent title company can locate it in minutes.

The Math That Actually Matters

Buy five properties this year in the same market and title updates can save you $3,000–$4,500.

That’s not rounding error.

That’s real money.

And over a decade of active investing, it compounds into something meaningful.

As the old line goes, “Measure twice, cut once.”

But measuring the same board over and over doesn’t make the cut any cleaner.

In other words:

Let’s stop paying for MRIs when a pulse check will do.

Pro Tip: What Are the States Where You Can’t Do the Quick Update (and What Should You Do?)

Not all states play nicely with the “title update vs full search” shortcut. In a handful of places, customary practice or statute drives title companies to roll the clock back decades — sometimes far longer than a simple three-year window — and that makes the cheap update all but unavailable.

A few examples of states where long historical searches are the norm (or where a short bring-down is hard to obtain because of entrenched underwriting practice or minimum search requirements) include:

Iowa — where (as one industry attorney observed) the practice is closer to a full abstract and opinion rather than an insurance policy, and deep historical digging is standard.

Massachusetts — residential transactions often default to a 50-year search requirement under attorney standards.

Georgia — underwriting and local title standards often push 40- to 50-year chains of title.

Arkansas — state law requires a minimum 30-year title search.

Missouri — standard practices often treat a 45-year plant as the base for searches.

New York — customary title searches often go back 40–60 years.

North Carolina — title exams typically include at least a 30-year lookback.

Kansas — statutory and underwriter expectations often tie searches to multi-decade chains of title.

That isn’t an exhaustive list of all situations where a title update might be unavailable, because underwriting custom, attorney practice, and local market norms vary widely — but it gives you a sense of the states where the default is deeper historical digging rather than a quick reissue credit.

So what can you do?

To put it bluntly:

Suck it up, buttercup.

In states like these, the local legal and underwriting frameworks make big historical searches the default. There isn’t a magical workaround.

Your practical choices are:

Bake the cost into your pro forma — assume you’re paying full title expenses and budget accordingly;

Ask early and explicitly for a title update or reissue rate — sometimes the carrier will still give the reduced premium if the facts support it;

Or, if you’re feeling ambitious and have a very long attention span, run for state legislature, work there for a dozen years, and come back with updated law… but that’s probably not how you want to spend your investing career.

The reality is this: in most of the country a title update will save you money when the previous sale is recent. In a few markets — where law, underwriting custom, or attorney practice demand deep historical searches — the savings opportunity simply doesn’t exist yet.

Plan around it. And keep your eyes open for the places where due diligence doesn’t have to be redundant — that’s where you’ll win the quiet competitions no one else is paying attention to.

Different by design.

There’s a moment when you open the news and it already feels like work. That’s not how staying informed should feel.

Morning Brew keeps millions of readers hooked by turning the most important business, tech, and finance stories into smart, quick reads that actually hold your attention. No endless walls of text. No jargon. Just snappy, informative writing that leaves you wanting more.

Each edition is designed to fit into your mornings without slowing you down. That’s why people don’t just open it — they finish it. And finally enjoy reading the news.