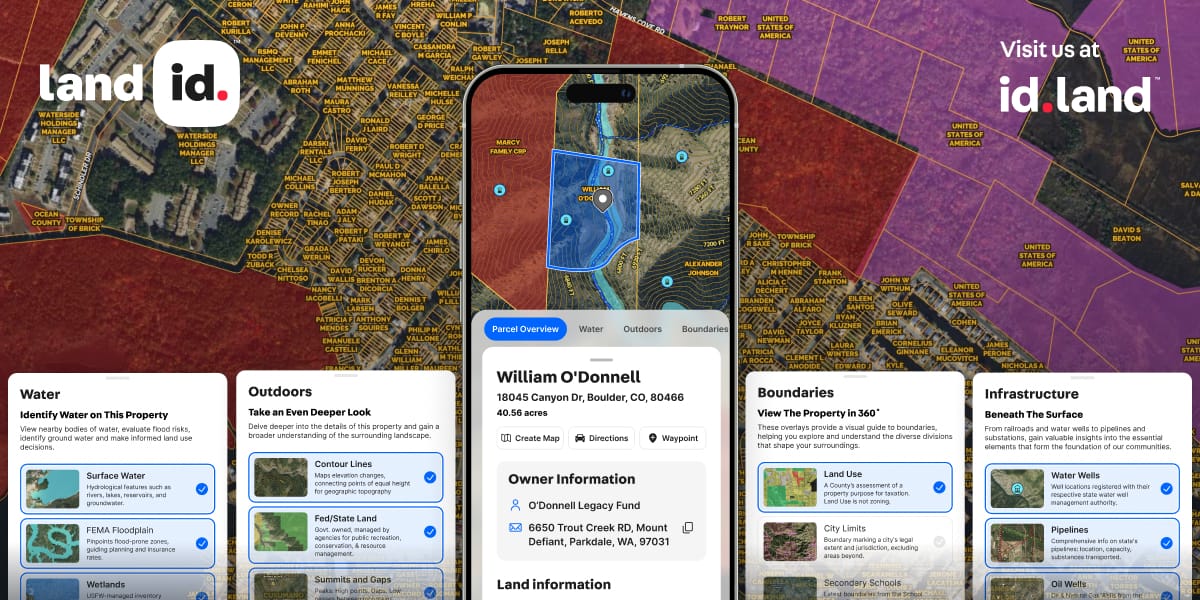

The Real Estate Professional’s Secret Weapon - Land id™

Discover extensive nationwide private parcel data, create & showcase powerful, shareable, interactive maps of any property: Fast, Easy and Mobile, with Land id™.

With the brand new streamlined Property Info Cards, Land id™ brings industry leading data and contextual layers to the forefront in a single tap or swipe.

How does this help me make better decisions?

The required rate of return (RRR) is the minimum amount of return an investor expects to receive for taking on the risk of investing in a company's stock or project. The RRR will vary according to the perceived risk of the project.

Rental income in an industrial space in a booming metropolis is a relatively low risk and the RRR may be lower. Investing in a beachfront condo project in a developing nation presents substantially higher risk and therefore a higher RRR would be set.

When buying foreclosures, for example, we counter the risk by setting our RRR at 50%. This acknowledges the high risk and the occasional bad surprises. Many investors seek a 30% RRR for investments outside the US. Each investor sets their targets, and acts accordingly.

Sponsored