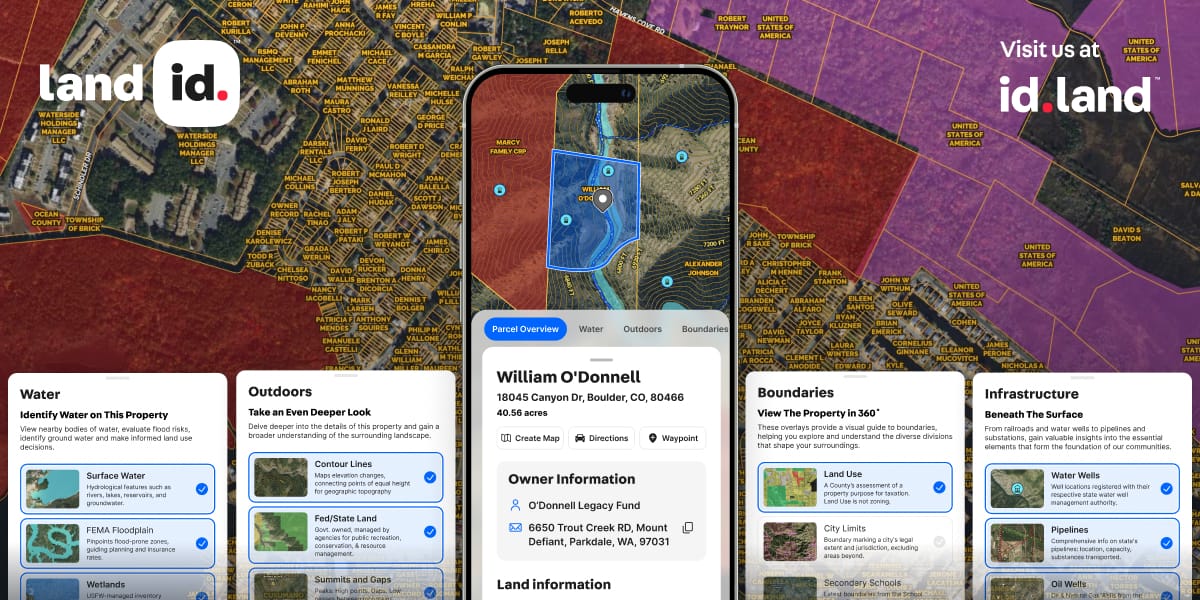

The Real Estate Professional’s Secret Weapon - Land id™

Discover extensive nationwide private parcel data, create & showcase powerful, shareable, interactive maps of any property: Fast, Easy and Mobile, with Land id™.

With the brand new streamlined Property Info Cards, Land id™ brings industry leading data and contextual layers to the forefront in a single tap or swipe.

Methods for Funding the Gap

1. Private Money Lenders

Advantages:

Quick access to funds.

Flexible terms and conditions.

Disadvantages:

Higher interest rates.

Shorter repayment periods.

Private money lenders are individuals or small companies that offer loans based on the value of the property rather than the borrower's creditworthiness. This is beneficial for both commercial and residential investors who need fast cash to close deals or cover unexpected costs.

2. Hard Money Loans

Advantages:

Fast approval and funding.

Less stringent credit requirements.

Disadvantages:

High interest rates and fees.

Short loan terms.

Hard money loans are similar to private money loans but are typically offered by companies rather than individuals. They are secured by the property and are often used for short-term financing needs.

3. Equity Partnerships

Advantages:

No debt repayment pressure.

Shared risk and expertise.

Disadvantages:

Shared profits.

Potential for conflicts with partners.

Equity partnerships involve bringing in investors who provide capital in exchange for a share of the profits. This can be an attractive option for larger commercial projects or residential developments that require significant funding.

4. Bridge Loans

Advantages:

Quick funding.

Can be used to secure long-term financing.

Disadvantages:

High interest rates.

Short repayment period.

Bridge loans are short-term loans used to "bridge" the gap until long-term financing is secured. They are particularly useful in commercial real estate when waiting for a permanent loan to be approved.

5. Crowdfunding

Advantages:

Access to a large pool of investors.

Can raise significant amounts of money.

Disadvantages:

Requires a strong marketing effort.

Regulatory compliance can be complex.

Crowdfunding platforms allow investors to pool their resources to fund real estate projects. This method is growing in popularity for both residential and commercial investments, offering a modern twist on traditional financing.

Conclusion

Gap funding is an essential part of real estate investing, providing the necessary resources to complete projects when traditional financing falls short. Each method of gap funding comes with its own set of advantages and disadvantages, and the choice depends on the specific needs and circumstances of the investor. By understanding these options, investors can better navigate the financial landscape and successfully bring their projects to fruition.